In the previous article, we discussed how to obtain a mortgage. One of the keys to obtaining a mortgage (and receiving the lowest possible interest rate) is having a good credit score. In this article, we will discuss some of the ways to improve your credit score.

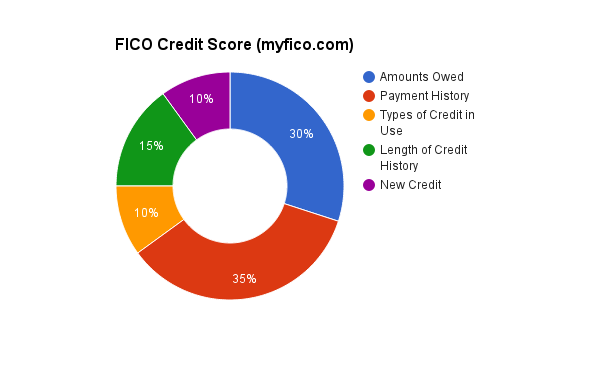

According to FICO, one of the main sources of credit scores, there are several factors that influence your credit score. These factors include:

- Payment History: On-time payments are critical to maintaining a favorable credit score. Late payments will harm your score. This has the greatest influence of any other factors on your FICO credit score.

- Amount Owed: High outstanding debt can reduce your credit score.

- Length of Credit History: Stability and consistency are important to maintaining good credit. In general, the longer your credit history, the better your credit score.

- New Credit: Opening too many new lines of credit, such as credit cards, in a short period of time can look risky and lower your credit score.

- Types of Credit in Use: Mortgage loans, retail accounts, credit cards, and more can be a factor in your credit score. The credit mix is typically not a crucial factor in determining your score.

There are many ways you can improve your credit. Even if you are trying to build credit for the first time, here are a few steps you can take to improve your score:

- Always make payments on time. This is the most important step to maintaining good credit. Late payments on credit cards, household utilities, or other loans can cause significant damage to your credit score.

- Use a credit card regularly. If you don’t have a credit card, consider opening one.

- Keep your credit card debt low. If you can’t immediately pay off a purchase, you should think twice before charging it to a credit card. Keeping debt low helps your credit score and helps you avoid paying extra interest on purchases.

- Keep credit cards and other accounts open for as long as possible. Length of credit history and average account age are important factors in determining your score.

You can obtain a free credit report once per year at https://www.annualcreditreport.com. Though the free report may not list your numerical score, it will show your creditors, and therefore help you to understand what you can do to further improve your credit.

Consistency and patience are key to good credit. Your score will not become perfect overnight, but by following the tips above, your score will improve over time. Since it takes time to build credit, start as early as possible. If you wait, you may find yourself wanting to buy a home but unable to obtain a mortgage due to a low credit score or lack of credit history.

If you are interested in hiring a professional realtor who can guide you through this process, Donna Gundle-Krieg loves working with people and would be happy to provide you with more information. She has many exciting listings available in great Antrim County locations, which you can view here. You can contact her at (231) 350-8507 or dokrieg@gmail.com to learn more.